Are Donations to a Booster Club Tax Deductible?

Are Donations to a Booster Club Tax Deductible?

Are donations to a booster club tax deductible? Well, yes and no. For those of you interacting with booster clubs in the past, the rules may have changed since you last visited the topic on your tax return. In the past, donations to a booster club with a 501(c)(3) nonprofit designation entitled you to a write-off on your tax return equal to 80% of the monetary value of your donation, even if goods or services were received. For example, if you donated $10,000 to a booster club in exchange for great seats at a football game, you may only be able to write off $8,000 on your tax return.

In 2019, the tax rules were changed. The good news is that donations to nonprofit booster clubs may still be written off; however, donations may only be written off if they are made with no exchange of goods or services taking place. So thinking through our above scenario, if you donate $10,000 to your favorite booster club, you can include the entire amount as a charitable donation to offset taxable income, as long as you do not receive any benefit from the booster club for doing so.

Booster clubs that do not have a 501(c)(3) nonprofit designation may accept donations, but contributors may not write them off as charitable giving for tax purposes. For these types of booster clubs, the booster club usually must declare any donations received as income and file a tax return showing those donations.

What Is 501(c)(3) Status?

501(c)(3) status is given to nonprofits that are considered public charities, private foundations, or private operating foundations. There are many benefits to becoming a 501(c)(3), and there are many resources available to apply for and receive your status quickly. Booster clubs that have this status are able to:

- Participate in fundraising programs

- Receive donations that are tax-deductible on the donor’s tax return

- Be exempt from paying federal income tax on their earnings

- Apply for exemption from state sales tax

- Qualify for state gambling licenses to operate BINGO and other games of chance

- Receiving a 501(c)(3) status is essential for booster clubs that seek to raise money to support their members.

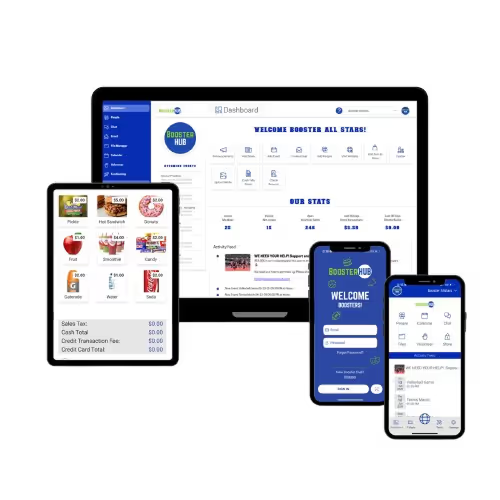

Booster Club Software

If you are involved in running a booster club, you may use a lot of different applications to manage your finances. BoosterHub software is designed specifically with booster clubs in mind. It can replace all of your other software applications, becaus it provides everything you need all in one platform. It is set up to manage donations, sales, and activities — all from one easy-to-use app! We recommend you apply for and receive your 501(c)(3) status so that you can make the best use of all of the BoosterHub tools, including the financial and fundraising tools. The BoosterHub system provides guard rails for the volunteers managing booster clubs, so that the financial information is easily accessible, easy to work with, and helps you comply with all of your city, state, and federal tax regulations.

Simplify Communications from App to Website

Take Control of Your Booster Club Spending with Debit Cards

.avif)