Can a Booster Club Use My Personal Venmo?

Can a Booster Club Use My Personal Venmo?

Well, yes, you can. But digging a bit deeper, is it something you should or should not do? Setting up a Venmo account for a booster club can seem like an easy way to simplify your club accounting. It’s digital, it’s easy, and almost everyone knows how to use it. Apps like Venmo can be an attractive alternative to cash and are more traceable and less susceptible to fraud or mismanagement.

However, using a personal Venmo account to conduct booster club business may have unintended consequences. Read on to learn more about the implications of using Venmo or other cash apps.

Tax Implications

As a club officer, you have the fiduciary responsibility of keeping track of club income and filing the appropriate tax returns at the city, state, and federal level, according to your state’s requirements. There are very few transfers of money that don’t trigger tax implications. Even if your organization has 501(c)(3) status, you still have to stay on top of your filing and track your cash flow in and out. You will still need to file a tax return.

Beware that using a personal Venmo account could mean that you have to declare the money as your personal income. Typically, this is not something that you want to do! Even if you are only using your Venmo account exclusively for booster club business, the IRS may not see it that way. And if the IRS doesn’t see it that way, you may be in for a big surprise. If you end up having to declare the Venmo transactions as income, you could be left with a hefty tax bill at the end of the year. Some booster clubs not only collect tens of thousands, but hundreds of thousands of dollars every year. Imagine having to pay the personal tax bill on that!

In addition, while Venmo has some reporting features, it could be more difficult to run reports or track cash flow than with a bank account or other payment system. If you are using your personal account for the club and personal transacting, it can be a nightmare to file taxes at the end of the year. All of the treasurer’s time spent tracking money needs to be factored into your decision on whether to use a booster club specific software platform like BoosterHub.

Venmo Fees

In addition to the tax implications, using Venmo for a booster club has fees that you’ll have to consider. Many Venmo users link their accounts to a credit card, which means that you will have to factor in an additional 3% transaction fee. Have you factored these fees into your thinking about which system to use? Depending on how much income you generate each year, this percentage could end up being a significant amount. It may be the deciding factor in your choice of payment processors.

Using other forms of payment can help you avoid these fees and ensure that every dollar from your supporters is going toward your cause. One of the big turn offs for donors is to know that a large percentage of their donation is not actually going to the club, but toward fees!

Checks and Balances

Good accounting practices in a booster club call for having checks and balances in place to ensure accountability. Often that means having multiple officers who have access to the club’s finances. The more eyes are on the transactions, the less of a chance for both innocent mistakes and fraud. Regular audits are recommended for booster clubs. This does not have to be expensive or even with a CPA. Any assistance you can get from contacts with financial accounting experience is helpful in identifying errors and keeping abreast of accounting best practices.

If you are using a personal Venmo account, it can be difficult to ensure that these checks and balances are in place. If you’re using your personal account for both the booster club and your personal finances, it can prove especially hard to manage. It may be hard to remember a year from now which charge was personal and which was for the booster club.

Alternatives to Venmo

Instead of using your personal Venmo account, you can set up a merchant account with a bank. This will allow you to easily take payments, and it will create a clean record of transactions that you can easily track.

A dedicated bank account makes it easier to be transparent about finances, and it makes filing taxes at the end of the year much simpler. It also prevents mixing personal finances with booster club finances, and you can easily answer any questions club members may have about the budget and cash flow.

If you were wondering, “Can a booster club take Venmo?” now you have your answer. Yes, however, setting up a separate bank account can be a good idea. It can seem formal for a small organization, but it’s the easiest way to track your finances and ensure accountability.

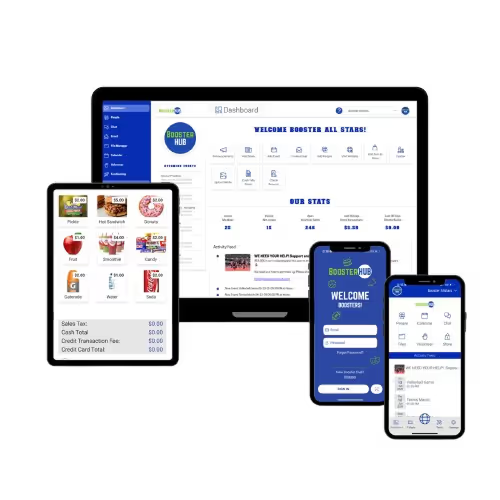

BoosterHub has an integrated online store, in-person concessions store, donation, and fundraising features. The BoosterHub accounting feature is a full accounting system, tailored specifically to booster clubs. In effect it is the guardrails that leads your booster volunteers down a path of accountability, visibility, reporting, and easy tracking of monies. BoosterHub’s physical payment terminals take credit cards, both swipe and chip, and Apple/Google Payments. BoosterHub also allows you to assign credit card processing fees to the purchaser, thereby the cost of fees to the club is $0.

Simplify Communications from App to Website

.avif)