What is the Difference Between a Sponsorship, Advertising and a Donation in a Booster Club: Navigating the Business Partnership Maze

Understanding the crucial distinctions that affect taxes, relationships, and fundraising success

Imagine this: A local business owner approaches your booster club wanting to support your programs. They're willing to write a check, but then they start talking about getting their logo on the scoreboard, being mentioned in your newsletter, and having a table at your awards banquet. Are they making a donation? Buying advertising? Creating a sponsorship? And why does it even matter?

Here's why it matters A LOT: these distinctions affect tax deductions for businesses, determine what you can promise in return, influence how you structure partnerships, and impact your organization's compliance requirements. Getting this wrong can create legal headaches, disappoint business partners, and limit your fundraising potential. Time to master the art of business partnerships that work for everyone!

Why These Distinctions Are Your Fundraising Superpower

Understanding the differences between sponsorships, advertising, and donations isn't just legal nitpicking – it's strategic fundraising intelligence that helps you create better partnerships, set proper expectations, and maximize revenue from business relationships.

According to the Association of Fundraising Professionals, organizations that clearly understand and communicate these distinctions raise 40% more from business partnerships than those that treat everything as generic "support." When you know exactly what you're offering and what businesses are buying, you can create compelling packages that deliver real value while staying compliant!

Donations: The Pure Gift

What Makes It a Donation

A donation is a pure gift with no expectation of receiving anything of substantial value in return. The business gives because they want to support your cause, not because they're getting marketing benefits.

Key Characteristics:

- No quid pro quo – nothing substantial given in return

- Fully tax-deductible for the business donor

- Charitable intent is the primary motivation

- Minimal or no recognition beyond basic acknowledgment

Examples of Pure Donations:

- A local restaurant writes a $500 check "to support the kids" with no strings attached

- A family business contributes $1,000 because the owner's daughter plays in the band

- A company makes an annual contribution as part of their community giving program

What You Can Offer for Donations

Appropriate Recognition:

- Thank you note or letter acknowledging their generosity

- Brief mention in newsletters or annual reports ("Thanks to XYZ Company for their generous support")

- Inclusion on donor lists without prominent placement or special formatting

- General program updates showing how donations make a difference

What You CANNOT Offer:

- Prominent logo placement on uniforms, banners, or promotional materials

- Advertising space in programs, websites, or newsletters

- Vendor booth opportunities at events

- Exclusive marketing rights or prominent recognition

Sponsorships: The Partnership Deal

What Makes It a Sponsorship

A sponsorship is a business arrangement where a company provides money or resources in exchange for marketing benefits and association with your organization or events. It's a partnership where both sides get value.

Key Characteristics:

- Mutual benefit exchange – company gets marketing value for their investment

- Partially tax-deductible – only the portion exceeding fair market value of benefits

- Marketing motivation alongside (or instead of) charitable intent

- Defined benefits package clearly outlining what sponsors receive

Examples of Sponsorship Deals:

- A car dealership pays $2,000 to have their logo on team uniforms and be title sponsor of your tournament

- A medical practice sponsors your concession stand for $1,500 and gets banner placement at all home games

- A local bank pays $5,000 to be the presenting sponsor of your awards banquet with table displays and speaking opportunities

Creating Sponsorship Packages

Common Sponsorship Benefits:

- Logo placement on uniforms, banners, programs, or promotional materials

- Event naming rights ("The Smith Family Dentistry Basketball Tournament")

- Website recognition with links to sponsor businesses

- Social media mentions and promotional posts

- Vendor booth space at events and activities

- Complimentary tickets or VIP access to events

Sponsorship Level Examples:

- $500 Bronze Sponsor – Logo in program, website recognition

- $1,000 Silver Sponsor – Uniform logo, banner placement, program ad

- $2,500 Gold Sponsor – Event naming rights, premium logo placement, vendor booth

- $5,000 Platinum Sponsor – Title sponsor benefits, speaking opportunities, exclusive recognition

Tax Implications for Sponsors

The Business Perspective:

- Marketing portion is a business expense (not charitable deduction)

- Excess value above marketing benefits may be deductible as donation

- Fair market value of benefits must be clearly established

- Documentation required showing breakdown between marketing value and charitable portion

Advertising: The Commercial Transaction

What Makes It Advertising

Advertising is a straight commercial transaction where businesses pay for promotional space or opportunities with no charitable component. They're buying marketing services at market rates.

Key Characteristics:

- Pure business transaction – no charitable intent required

- Not tax-deductible as a charitable contribution (but deductible as business advertising expense)

- Market-rate pricing for promotional opportunities

- Commercial relationship rather than charitable support

Examples of Advertising Arrangements:

- A restaurant buys a quarter-page ad in your program for $200

- A retail store pays $100 per game to have their banner displayed during basketball season

- A service business purchases email newsletter ad space for $50 per month

Setting Advertising Rates

Market-Based Pricing: Research what similar organizations charge for comparable advertising opportunities:

- Program ads – typically $50-$300 depending on size and circulation

- Banner displays – $25-$100 per event depending on visibility

- Website advertising – $20-$100 per month based on traffic

- Email newsletter ads – $25-$75 per send based on subscriber count

The Gray Area: Mixed Arrangements

When Lines Get Blurry

Many business relationships combine elements of donation, sponsorship, and advertising, creating mixed arrangements that require careful handling.

Example Mixed Arrangement: ABC Hardware pays $1,000 to support your baseball team and requests:

- Small logo on team banner ($200 advertising value)

- Mention in three newsletters ($150 marketing value)

- Two season passes ($100 value)

Tax Treatment:

- $450 total benefits = business advertising expense

- $550 excess payment = potentially tax-deductible donation

- Clear documentation required showing value breakdown

Documentation Best Practices

For All Business Relationships:

- Written agreements clearly outlining what each party provides and receives

- Fair market value assessments for all benefits provided

- Appropriate receipts showing tax-deductible vs. non-deductible portions

- Consistent application of policies across all business partners

Creating Clear Partnership Packages

The Menu Approach

Donation Options:

- Community Supporter ($250+) – Thank you recognition only

- Program Champion ($500+) – Newsletter acknowledgment and donor list inclusion

- Student Success Partner ($1000+) – Annual report feature and impact updates

Sponsorship Packages:

- Team Supporter ($300) – Logo on team banner, program listing

- Game Day Sponsor ($750) – Scoreboard recognition, PA announcements

- Season Champion ($1,500) – Uniform logo, multiple event recognition

Advertising Opportunities:

- Program Ads – Various sizes at market rates

- Website Banner – Monthly or seasonal placements

- Event Signage – Per-game or per-event advertising space

Communication Strategy

Setting Expectations Clearly:

- Explain differences upfront when businesses inquire about support

- Provide written materials outlining options and benefits

- Be transparent about tax implications for each type of arrangement

- Follow through consistently on promised recognition and benefits

Your Business Partnership Action Plan

Ready to master the art of business relationships?

- Create clear definitions and policies for donations, sponsorships, and advertising

- Develop written packages with specific benefits and pricing for each category

- Research market rates for advertising opportunities in your community

- Design tracking systems to ensure you deliver promised benefits

- Train your team on distinctions and tax implications

- Create documentation templates for different types of business relationships

- Review annually and adjust packages based on results and feedback

The Ultimate Partnership Victory

When you clearly understand and communicate the differences between donations, sponsorships, and advertising, you transform business relationships from confusing negotiations into professional partnerships that benefit everyone involved.

Businesses get exactly what they expect and pay for, whether that's pure charitable satisfaction, valuable marketing exposure, or commercial advertising space. Your organization maximizes revenue potential while staying compliant and building lasting relationships with the business community.

The key is treating each type of relationship with the professionalism it deserves – acknowledging pure donations appropriately, delivering promised sponsorship benefits consistently, and providing advertising value that justifies the investment.

Remember, successful business partnerships aren't about finding the perfect category for every relationship – they're about clear communication, fair value exchange, and professional follow-through that makes businesses want to continue supporting your programs year after year!

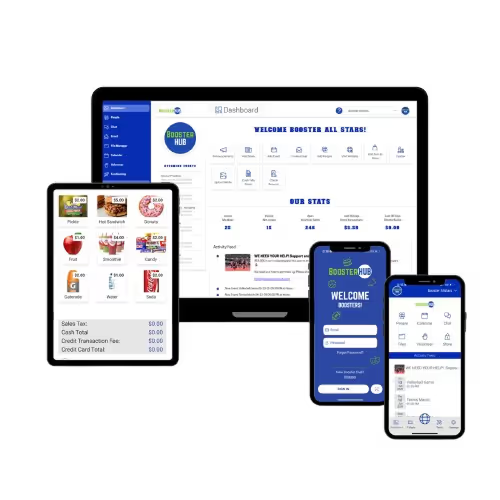

Ready to streamline your business partnerships? Visit BoosterHub.com to explore sponsorship management tools that make it seamless to raise money for your booster club.

Simplify Communications from App to Website

Take Control of Your Booster Club Spending with Debit Cards

.avif)